A statement left at the scene of the deadly shooting of a health insurance executiveThe terms “deny, defend, and depose” are frequently used to characterize the strategies used by insurers to evade paying claims.

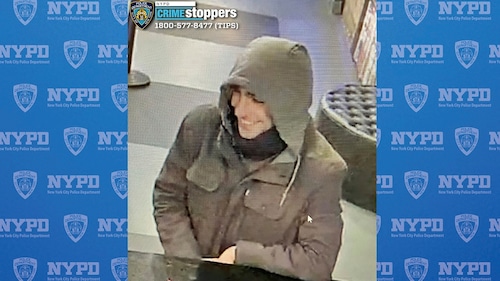

Two law enforcement sources told The Associated Press on condition of anonymity Thursday that the three phrases were inscribed on the ammo used by a masked shooter who killed UnitedHealthcare CEO Brian Thompson. They are comparable to the terms “delay, deny, defend,” which some lawyers use to explain how insurers refuse to pay for services, and the title of a book published in 2010 that was quite critical of the sector.

Regarding the language and any relationship between them and the popular term, police have not made any formal comments. However, the inscriptions on the ammo and Thompson’s shooting have provoked indignation on social media and elsewhere, expressing Americans’ growing dissatisfaction with the expense and difficulty of receiving medical care.

What is meant by the phrase?

Delay, deny, defend has become a catchphrase for those who criticize insurance. The phrases describe insurers refusing claims, postponing payment on claims, and defending their positions.

The term has been used to refer to a variety of insurers, including health, property, and auto.

Lea Keller, managing partner at Lewis and Keller, a personal injury legal practice based in North Carolina, stated that the longer they can postpone and reject the claim, the longer they can keep their money and not pay it out.

Jay Feinman’s 2010 book, Delay, Deny, Defend, explores the ways in which insurance respond to claims.

According to an excerpt on the book’s website, all insurance companies have an incentive to grow their clientele in order to boost earnings.

What connection does the expression have to UnitedHealthcare?

As one of the biggest health insurers in the country, UnitedHealthcare covered over 49 million Americans and earned over $281 billion in revenue last year. In recent years, lawmakers, physicians, and patients have frequently criticized UnitedHealthcare and its competitors for denying claims or making access to care more difficult.

Insurers, according to critics, are increasingly intervening with even regular care, resulting in delays that may affect a patient’s prospects of life or even recovery in some situations.

Why are insurers being criticized?

Prior authorizations, which require an insurer to approve surgery or therapy before it occurs, have caused a great deal of annoyance for both doctors and patients.

The insurer’s prior authorization refusal rate for certain Medicare Advantage patients has increased in recent years, according to a report released in October that named UnitedHealthcare. Competitors Humana and CVS were also included in the U.S. Senate Permanent Subcommittee on Investigations report.

According to insurers, strategies like prior authorization are important to reduce needless operations and stop abuse of care in order to help keep costs under control.

The coverage of care is not the only source of frustration. Many times, expensive, innovative drugs that help with obesity or reduce the progression of Alzheimer’s disease are either not covered at all or have coverage limitations.

Mario Macis, an economist at Johns Hopkins who focuses on health care system trust, said that many Americans see these businesses as motivated more by profit than by a desire to assist their clients. And this leads to a significant divergence.

What social media responses have surfaced?

Following Thompson’s death, social media was ablaze with rage and hate speech directed at health insurance. Comment sections brimming with resentment toward health insurers in general and UnitedHealthcare in particular were filled with user replies and, frequently, jokes.

According to a message on Instagram, “I would be happy to help look for the shooter, but vision is not covered under my healthcare plan.”

Preliminary authorizations and thoughts! Another user wrote.

What is the public’s perception of insurers?

Patients in the U.S. health care system are covered by a combination of government-funded programs like Medicaid and Medicare as well as private insurers like UnitedHealthcare. Because coverage frequently varies by insurer, it can be very annoying for both patients and providers.

These dissatisfactions with insurance firms in particular and the health care system in general are reflected in polls.

According to a February KFF study, over two-thirds of Americans said that health insurance corporations should bear a large portion of the burden for the high expense of healthcare.

According to a 2023 KFF study of persons with health insurance, the majority rate their coverage as excellent or good overall, but most also reported having an issue with their insurance during the preceding year. This included issues with pre-authorization, provider networks, and refused claims. When faced with insurance issues, nearly half of insured adults reported that they couldn’t find a satisfactory solution.

Note: Every piece of content is rigorously reviewed by our team of experienced writers and editors to ensure its accuracy. Our writers use credible sources and adhere to strict fact-checking protocols to verify all claims and data before publication. If an error is identified, we promptly correct it and strive for transparency in all updates, feel free to reach out to us via email. We appreciate your trust and support!