Washington (AP) Donald Trump, the incoming president, ran on a platform of lowering excessive borrowing costs and relieving the financial strain on American consumers.

However, what if interest rates continue to be high, significantly higher than they were before to the pandemic, as many economists predict?

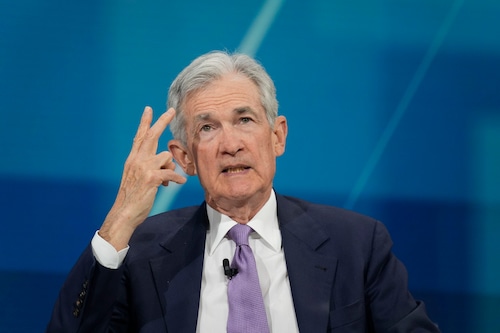

The Federal Reserve, and specifically its chair Jerome Powell, whom Trump himself appointed to head the Fed, could be blamed by Trump. Trump loudly and often criticized the Powell Fed during his first term, claiming that it maintained excessively high interest rates. Trump’s criticism of the Fed sparked widespread worries about political meddling in the Fed’s decision-making process.

Powell underlined the Fed’s independence on Wednesday, saying it allows us to make judgments that are always in the best interests of all Americans, regardless of political party or result.

Conflicts over politics may be unavoidable during the next four years. In an economy that is nearly at capacity, Trump’s plans to lower taxes and apply severe and pervasive tariffs are surefire ways to cause high inflation. Additionally, the Fed would have to maintain high interest rates if inflation were to pick up speed again.

Why is there so much fear that Powell will be fought by Trump?

Powell won’t necessarily lower interest rates as much as Trump would like. Additionally, Trump’s actions may keep other borrowing costs, such as mortgage rates, high even if Powell lowers the Fed’s benchmark rate.

Trump has promised to impose far higher tariffs, which might make inflation worse. Inflationary pressures may also be exacerbated if tax cuts on overtime pay and tips—another Trump pledge—accelerated economic growth. Trump’s pledges of lower borrowing rates would be thwarted if the Fed responded by pausing or halting its rate decreases. If inflation increased, the central bank might even boost interest rates.

Olivier Blanchard, a former top economist at the International Monetary Fund, recently stated that there is a very high chance of disagreement between the Trump administration and the Fed. The Trump administration’s goals will be thwarted if the Fed raises interest rates.

However, isn’t the Federal Reserve lowering interest rates?

Yes, but the Fed’s officials might only lower rates a few times more than they had predicted a month or two ago because the economy is stronger than forecast.

Additionally, those rate reductions may not significantly lower borrowing costs for businesses and households. Credit card, small company, and other loan rates can be influenced by the Fed’s benchmark short-term rate. Longer-term interest rates, however, are beyond its direct control. Among these is the 10-year Treasury note yield, which has an impact on mortgage rates. In addition to supply and demand for Treasuries, investors’ predictions of future inflation, economic growth, and interest rates also influence the 10-year Treasury yield.

This year, for instance. In late August, the 10-year yield dropped in expectation of a rate cut by the Fed. However, longer-term rates did not decrease after the initial rate cut on September 18. Rather, they started to increase once more, in part because they were expecting economic development to pick up speed.

Additionally, Trump has put forth a number of tax cuts that would increase the debt. In order to get enough investors to purchase the new debt, rates on Treasury securities may then need to increase.

Economist and faculty director at the Penn Wharton Budget Model Kent Smetters stated, “I honestly don’t think the Fed has a lot of control over the 10-year rate, which is probably the most important for mortgages.” In that sense, deficits will be far more significant.

Alright, so Trump and Powell argue, but so what?

As long as the Fed maintains its authority to set policy, occasional or infrequent criticism of the Fed chair need not be detrimental to the economy.

However, ongoing assaults would likely weaken the Fed’s political independence, which is vital for controlling inflation. A central bank frequently has to take extremely unpopular actions to combat inflation, most notably raising interest rates to curb borrowing and spending.

Historically, political leaders have favored central banks to maintain low interest rates in order to boost the economy and the labor market, particularly in the run-up to an election. According to research, nations with autonomous central banks typically have lower rates of inflation.

Trump’s constant criticism may cause issues even if he doesn’t legally compel the Fed to take any action. Markets, economists, and business executives will lose faith in the Fed’s ability to control inflation if they believe the Fed is no longer acting independently and is instead being manipulated by the president.

Additionally, once consumers and businesses expect inflation to increase, they typically take actions that drive up prices, such as buying more before prices go up further or raising their own pricing if they anticipate higher expenses.

Scott Alvarez, a former general counsel at the Fed, stated that the markets must have faith that the Fed is acting on the data and not political pressure.

Could Powell be fired by Trump?

He could attempt it, but it would probably result in a drawn-out legal dispute that might even reach the Supreme Court. Powell made it apparent at a press conference in November that he doesn’t think the president has the legal right to do so.

Powell would win in court, according to the majority of experts. Furthermore, from the standpoint of the Trump administration, such a battle might not be worthwhile. Powell’s tenure expires in May 2026, at which point a new chair may be nominated by the White House.

Additionally, if Trump made such a bold endeavor, the stock market would probably plummet. Mortgage rates and other borrowing costs would likely increase when bond yields did.

If Trump is perceived as selecting a loyalist to succeed Powell as Fed chair in 2026, financial markets may potentially respond unfavorably.

Hasn’t the Fed been attacked by past presidents?

Yes, and it resulted in persistently high inflation in the worst circumstances. Interestingly, in 1971, President Richard Nixon pushed Fed Chair Arthur Burns to lower interest rates because Nixon wanted to be re-elected the following year, and the Fed complied. Economists attribute the persistent inflation of the 1970s and early 1980s to Burns’ inability to maintain rates high enough.

According to Thomas Drechsel, an economist at the University of Maryland, when presidents meddle in the Fed’s interest rate choices, prices and expectations rise steadily. This worries me because it could lead to inflation becoming deeply ingrained.

Presidents have studiously avoided public criticism of the Fed since the mid-1980s, except for Trump during his first term.

Peter Conti-Brown, a professor of financial regulation at the University of Pennsylvania’s Wharton School, remarked, “It’s amazing how little manipulation for partisan ends we have seen of that policymaking apparatus.” It truly is an accomplishment of American leadership.

Are central banks in other nations autonomous?

Yes, the majority of developed economies do. However, governments have attempted to control interest-rate policy in a few recent instances, such as South Africa and Turkey. And rising inflation has usually come next.

For years, despite price increases, Recep Tayyip Erdogan, the president of Turkey, pushed the central bank to lower interest rates. Three central bankers who had disobeyed him were even dismissed. As a result, official estimates showed that inflation soared to 72% in 2022.

Erdogan finally changed his mind and permitted the central bank to boost interest rates last year.

Note: Every piece of content is rigorously reviewed by our team of experienced writers and editors to ensure its accuracy. Our writers use credible sources and adhere to strict fact-checking protocols to verify all claims and data before publication. If an error is identified, we promptly correct it and strive for transparency in all updates, feel free to reach out to us via email. We appreciate your trust and support!