By Duke Han and Laura Fenton

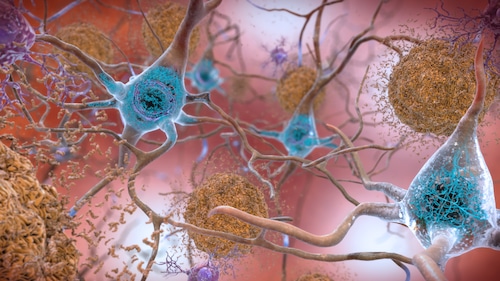

Some elderly persons may be more vulnerable to financial abuse because of a brain area that is impacted very early in Alzheimer’s disease. Our recent study, which was published in the journal Cerebral Cortex, has it as its main finding.

As a clinical neuropsychologist and a PhD student in clinical psychology, we are curious to know if a higher risk of financial exploitation, such as falling for a scam, could be a behavioral predictor of cognitive deterioration in the future.

This concept is supported by more studies. However, little is known about the relationships between anatomical brain regions and susceptibility to financial exploitation.

In a cohort of 97 persons aged 52 to 83 who showed no symptoms of cognitive impairment, we investigated the relationship between susceptibility to financial exploitation and the thickness of the entorhinal cortex, a part of the brain that is impacted very early by Alzheimer’s disease.

As a result, we postulated that thinning this area would make it more difficult to consider past experiences and future outcomes when determining the importance of particular choices.

According to our research, a self-report questionnaire measuring financial vulnerability was linked to a lower entorhinal cortex thickness as determined by a brain scan. We found no correlation between the thickness of the dorsolateral prefrontal cortex and the ventromedial prefrontal cortex, two areas of the frontal cortex, and susceptibility to financial exploitation. These areas of the frontal brain are less frequently linked to early Alzheimer’s disease and more frequently to decision-making.

Why it is important

Our main objective is to support Alzheimer’s disease early detection. Because Alzheimer’s disease-related brain alterations start decades before noticeable clinical symptoms appear, early detection is vital. Because of this, irreversible brain damage frequently occurs before an individual is diagnosed with Alzheimer’s disease. Intervention and therapy attempts become extremely difficult as a result.

Our research contributes to a growing body of research that suggests poor financial decision-making could be a behavioral indicator of cognitive deterioration in the future. This could assist in locating patients when their illness is still in its early stages, when intervention and therapy may be more successful.

It’s important to note, though, that not all elderly persons who are financially exploited will go on to get Alzheimer’s disease. Indeed, a person may be more vulnerable to financial exploitation for a variety of additional reasons, such as environmental, physical, and emotional ones.

Instead, our group’s and other researchers’ study indicates that financial exploitation susceptibility could be a crucial component of a risk profile and should warn individuals about the potential need for more thorough testing. For instance, brain scans, neuropsychological testing, and blood tests for Alzheimer’s disease neuropathology could give people a more complete picture of their risk of cognitive loss in the future.

What is yet unknown

Our study has significant limitations. We did not have precise measurements of the neuropathology of Alzheimer’s disease, and we gathered all the data at a single moment in time. Therefore, it’s unclear if variations in thickness were actually caused by brain alterations associated with Alzheimer’s disease or if they were just the product of preexisting disparities or other factors.

Furthermore, the majority of our participants were female, Caucasian, and well educated. This makes it more difficult for us to generalize the results, which is a gap that has to be filled in future studies.

Our team is tracking individuals over time and incorporating pathology measures for Alzheimer’s disease into our research. This will enable us to determine whether alterations in brain structure over time are linked to early Alzheimer’s disease and whether they increase susceptibility to financial exploitation.

Laura Fenton is a clinical psychology doctoral student in the Dornsife College of Letters, Arts, and Sciences at the University of Southern California.

Duke Hanis is a psychology and family medicine professor in the Dornsife College of Letters, Arts, and Sciences at the University of Southern California.

Note: Every piece of content is rigorously reviewed by our team of experienced writers and editors to ensure its accuracy. Our writers use credible sources and adhere to strict fact-checking protocols to verify all claims and data before publication. If an error is identified, we promptly correct it and strive for transparency in all updates, feel free to reach out to us via email. We appreciate your trust and support!