By MacDowell, Michael A.

Because he was sick of hearing his economic advisors declare, “On the one hand, you will have this outcome, and on the other hand, you will have another,” Harry Truman allegedly requested a one-armed economist.

These claims create the impression that economists disagree, and that disagreements are over policies that frequently have political underpinnings. However, the majority of economists agree on a few fundamental ideas, one of which is that tariffs hurt both the economy as a whole and individual consumers.

David Ricardo, an economist and stockbroker from London, originally stated one of the fundamental ideas of economics in 1817. He stated in his book Principles of Political Economy that the cost of manufacturing one good in comparison to another is more important in determining what goods a nation should produce than its absolute production capabilities.

To illustrate, economist Donald Boudreaux uses a straightforward example. Let’s say that Anna and Bob are two individuals. Their sole food sources are fish and bananas, and they dwell alone on a lonely island. Anna may harvest 100 bunches of bananas per month if she dedicates all of her time to the task. She can catch 200 fish a month if she dedicates all of her time to fishing. Bob can catch 100 fish per month when fishing and 50 bunches of bananas each month when collecting bananas. They might divide their time between fishing and banana collecting, but they soon come to the conclusion that although Anna is completely superior at both, fishing is her comparative advantage.

After deciding that it makes sense for Bob to do the collecting and Anna to do the fishing, they exchange with each other.

The same is true for nations. Computers and automobiles may be produced more effectively in one nation than another. But if both nations focus on creating items in which they have a comparative advantage, then trade with another nation that has a comparative advantage in a different product, both nations benefit.

Comparative advantage applies to all countries exchanging a wide variety of commodities, even if international trade is considerably more complicated than two countries trading two goods. Countries should ideally focus on manufacturing goods in which they are competitive. Above all, comparative advantages increase the global economy’s total productive potential. More is created and everyone wins when trading partners produce goods in which they have a competitive advantage and exchange them for other goods instead of producing them themselves.

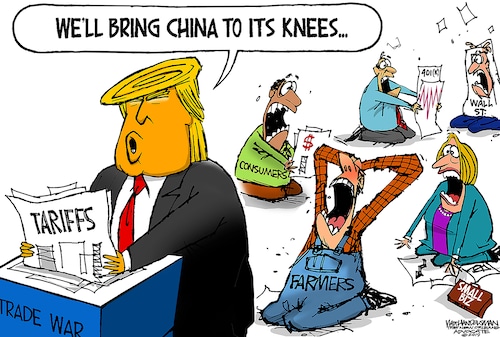

Taxes known as tariffs increase the cost of imported goods, making them more expensive for consumers. By forcing nations to create goods that are more expensive than they would be in the absence of tariffs, tariffs also cause them to deviate from their best production choices.

Tariffs reduce global production by causing inefficiencies. Economists’ opposition to tariffs stems from this decline in global productivity. To put it briefly, tariffs increase prices and reduce productivity.

Naturally, this presupposes ceteris paribus, as economists like to say, that everything else is equal. Not everything is created equal. The elimination of government intervention through subsidies, state ownership, taxation, regulation, and intellectual property theft is necessary for a free trade system in which each nation fully utilizes its comparative advantages.

Therefore, China subsidizes domestic businesses to enable them to produce items for export below their full cost of production when it determines that local full employment is vital.

Comparative advantage is also hindered when the high technical expenses of creating complex items, such as computer chips, are artificially reduced by stealing intellectual property from other businesses.

Trump and a few of his advisors have suggested that tariffs are a component of a negotiation strategy aimed at making our trading partners realize that they need to deal fairly and, in the case of China and Mexico, preventing the export of harmful drugs to the United States. Although these are admirable objectives, there will be many obstacles to overcome before tariffs can be implemented in the US, including higher prices and a high risk of inflation reoccurring.

For this reason, the majority of economists raise both hands when arguing against tariffs.

Former Misericordia University President Emeritus Michael A. MacDowell taught economics on occasion. The Calvin K. Kazanjian Economics Foundation has him as one of its directors.

Note: Every piece of content is rigorously reviewed by our team of experienced writers and editors to ensure its accuracy. Our writers use credible sources and adhere to strict fact-checking protocols to verify all claims and data before publication. If an error is identified, we promptly correct it and strive for transparency in all updates, feel free to reach out to us via email. We appreciate your trust and support!