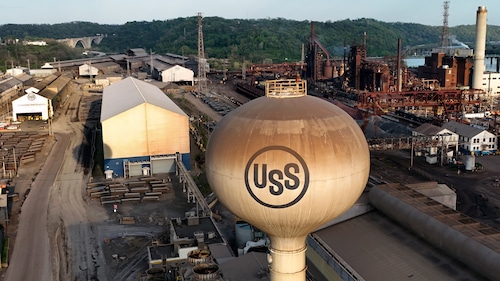

HARRISBURG (AP) Even as rumors of a fresh bid for the legendary Pittsburgh steelmaker started to surface on Monday, the bid by Japan’s Nippon Steel to acquire U.S. Steel might have a new lease on life.

In a press conference on Monday, Lourenco Goncalves, the CEO of Cleveland Cliffs, a steel manufacturer based in Ohio, stated his desire to submit a fresh bid for U.S. Steel, which in 2023 accepted the buyout offer from Nippon after rejecting an offer from Cleveland-Cliffs.

During a news conference at a Cleveland-Cliffs mill in western Pennsylvania, Goncalves stated that the bid is an all-American way to salvage U.S. Steel, but he would not provide any financial details. He declared that he would merge Cleveland-Cliffs with U.S. Steel, move its headquarters to Pittsburgh, and maintain the U.S. Steel name.

After President Joe Biden delayed the deal, the Biden administration extended the deadline over the weekend for the Japanese steelmaker to rescind its ambitions to buy U.S. Steel.

Even though President-elect Donald Trump, who takes office in a week, is also against the merger, U.S. Steel and investors reportedly saw the revised deadline, which is now in mid-June, as a chance to finish the acquisition.

Although the U.S. Committee for Foreign Investment in the United States, or CFIUS, was unable to agree on the security issue, Biden cancelled the transaction this month, citing a possible national security concern.

under a statement released on Sunday, U.S. Steel expressed its satisfaction that the CFIUS has extended the requirement under President Biden’s Executive Order that the parties permanently terminate the acquisition until June 18, 2025. In order to ensure the best future for the American steel sector and all of our stakeholders, we are eager to complete the transaction.

U.S. Steel’s stock increased 6% during Monday’s trade.

Biden and Trump swiftly pledged on the campaign trail in a crucial swing state to thwart the proposed pact, which sparked an election-year political storm across America’s industrial heartland.

Trump stated on social media in December, even after the election, that he is adamantly opposed to a foreign business purchasing U.S. Steel and that he would thwart the transaction if elected president. This month, after Biden stopped it, he reaffirmed that position.

A CFIUS made up of Trump appointees and Trump himself, however, might be allowed to accept the deal or work out new conditions.

A new CFIUS and a new president are not legally bound by Biden’s decision, according to Dennis Unkovic, a Pittsburgh attorney who specializes in foreign corporate transactions, including those that required CFIUS clearance.

According to Unkovic, it is unusual for CFIUS to give the parties a further six months to terminate the agreement. Unkovic cited allegations that Biden’s CFIUS was split on whether it constituted a security threat, though it was not immediately apparent why the CFIUS extended the deadline.

According to Unkovic, the extension from the 30-day period to the 180-day period indicated that there were members of the Biden administration who wanted someone to look into this further.

According to Unkovic, CFIUS’s role is to determine if a deal can be completed through modifications or workarounds, and deals are rarely rejected. Trump may still make the final decision when CFIUS reviews it again.

Who knows how he will react to it now? “Unkovic said.”

Biden’s move to block the sale was a political ploy and a breach of due process, according to Nippon Steel and U.S. Steel, who have maintained that the merger poses no national security threat to the United States.

Three days after Biden’s statement, the two steel corporations filed a lawsuit in federal court, accusing Cleveland-Cliffs and Goncalves, the leader of the Steelworkers union, of conspiring to thwart the buyout.

Concerned about whether the firm will uphold current labor agreements or eliminate jobs, the United Steelworkers have opposed the Nippon Steel deal and questioned the company’s credibility as an honest broker for national trade interests in the United States.

Nonetheless, a few union members have publicly supported the agreement. The fourth-largest steelmaker in the world, Nippon Steel, claims that its capacity to invest in American Steel’s outdated blast furnace facilities in Indiana and Pennsylvania will strengthen American competitiveness in a Chinese-dominated market.

Without Nippon Steel’s funding, U.S. Steel has threatened to relocate its headquarters from Pittsburgh and switch operations from blast furnaces to less expensive non-union electric arc furnaces.

According to Goncalves, his company’s ability to submit a new bid depends on U.S. Steel and Nippon Steel terminating their deadlocked contract; he is unable to do so until that occurs.

“They can’t accept my offer if I make it today,” Goncalves stated. Therefore, the first thing that must be done is to revoke the merger agreement.

Additionally, he proposed that Trump’s CFIUS revert the Nippon-U.S. Steel deal’s termination deadline to February 3, which was Biden’s initial deadline.